Issue #6: How to Avoid Overpaying for Financial Advice

Discover how a 'small' 1% advisor fee could drain nearly $80,000 from your portfolio and why flat fees are the smarter choice.

Reading time: 2 minutes

Hey there,

Just a quick heads-up before we begin.

I’ve decided to change the structure of the newsletter to make it even more engaging, easier to digest, and quicker to read.

Instead of one long newsletter once a week, you’ll now get 6 shorter ones, delivered daily from Tuesday to Sunday.

Thank you for being part of this journey and for trusting me to bring value to your inbox.

Well, let’s get into it!

Financial Life Hack #11

There are 2 kinds of financial advisors.

The first type charges a flat fee. You might pay by the hour, per project, or through an annual retainer. They don’t care about the size of your portfolio; they’re paid to give you advice.

Then, there’s the percentage-based financial advisor, the leeches of the investment world, who charge a percentage of your portfolio each year, typically 1%.

Here’s why you should never work with the second type.

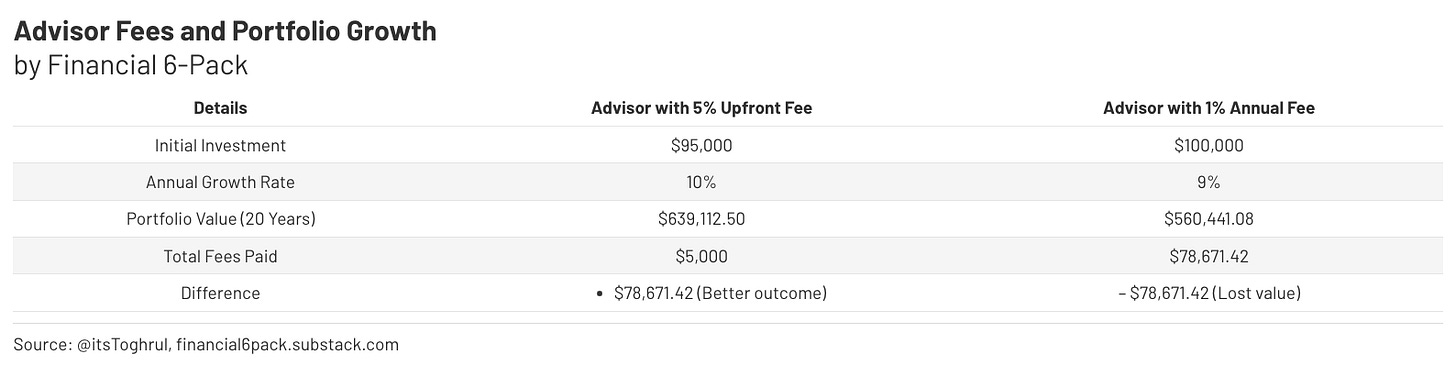

Let’s say you have $100,000 to invest.

The first advisor takes $5,000 upfront (a 5% fee based on your capital).

Painful? Maybe.

But once that’s done, you’re left with $95,000 to invest. Assuming a 10% annual growth rate over 20 years, your investment would grow to $639,112.50.

With the percentage-based advisor, you start with the full $100,000, but they take 1% every single year. So, instead of a 10% growth rate, you’re stuck with 9%.

Because of that, after 20 years, your portfolio would grow to only $560,441.08.

That 1% annual fee you thought wasn’t much when you agreed to work with the leech just cost you $78,671.42.

Even a tiny leak can sink a big ship, and unnecessary fees are no different. Smart investing starts with identifying and cutting those hidden costs. Make your portfolio work for you, not for your advisor.

Thank you so much for reading! Sending you a big virtual hug, and I’ll catch you tomorrow!