Issue #33: The Decision That Separates Great Investors From Average Ones

Average investors play it safe. Great ones make this move when it matters most.

Reading time: 4 minutes

When investors have two seemingly undervalued opportunities, the dilemma arises whether to back the one with superior prospects, the “faster horse,” or to split capital between both.

A “faster horse” refers to the investment expected to deliver stronger returns or outperform its peer. The strategy of reallocating capital toward the faster horse means concentrating more or all funds in that better idea rather than diversifying equally.

If you genuinely can identify the best opportunity, concentrating on it should maximize returns. However, this is easier said than done. It requires accurately picking the winner in advance and tolerating the risk that comes with an undiversified bet.

As I pointed out back in Issue #2, concentration builds wealth, and diversification merely preserves it. And as you know, I’ve always been a strong advocate for concentrated portfolios.

If you and I took even half the time we spend doomscrolling or watching motivational videos on YouTube and redirected it into researching just a few companies, we’d be far better off.

You don’t need months of analysis or an army of analysts to spot a great opportunity. In most cases, a weekend of honest, logical research is all it takes to be ahead of Wall Street. Especially if you’re using the product every day or work in the same industry, that firsthand insight alone gives you a real edge. Everything else you dig up is just bonus material that helps solidify what you already know.

Of course, this isn’t without risk. Picking the wrong horse in a two-horse race can set you back hard. But that’s the deal with conviction, you’re trading safety for potential outperformance. The question is whether the reward justifies the risk. And more often than not, it does, if you’ve done the work.

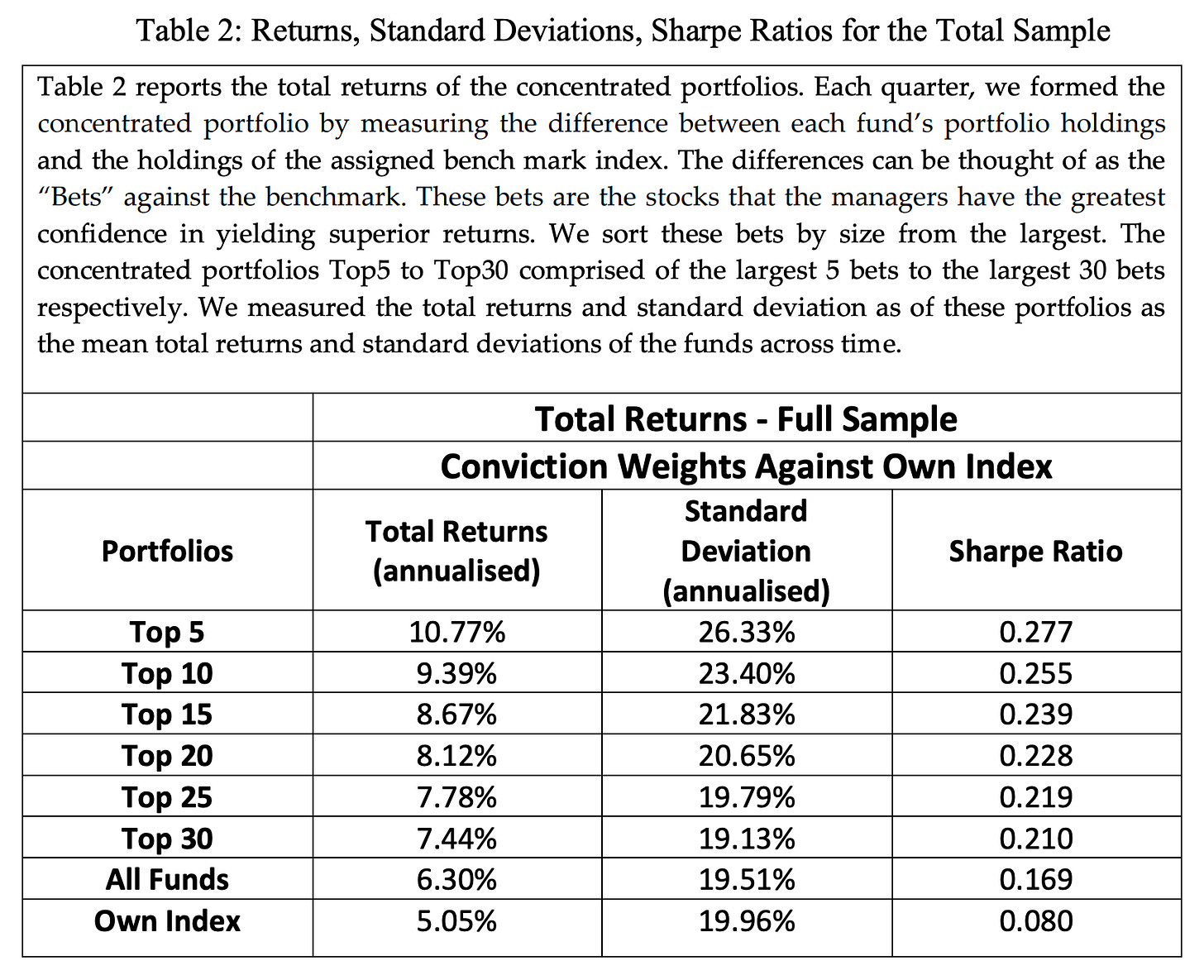

In fact, a study analyzed thousands of mutual funds and found that if fund managers had simply stuck to their top five highest-conviction ideas, they would’ve significantly outperformed both their own diversified portfolios and the broader market. The more they diversified beyond their best ideas (10, 20, 30 stocks), the more their returns were watered down.

Large institutional investors cannot concentrate too heavily, even if they want to, due to liquidity (if it’s a thinly traded stock, they can’t put 50% of their fund in it without owning the whole company) or mandate constraints (fund rules often limit position sizes to manage risk). They also have to consider career risk because a fund manager who goes all-in on one stock and is wrong could lose clients or their job.

Thus, many professional investors diversify “to survive,” whereas us, individual investors with high conviction and no such constraints, might be more free to concentrate. This means the faster-horse strategy is often more applicable at smaller scale or in personal portfolios than in, say, a large mutual fund (with some exceptions like very bold hedge funds).

Questions to Ask Before Reallocating

Is the asset I'm reallocating overvalued or undervalued?

How will this reallocation affect my overall portfolio risk?

Does this move maintain a sufficient margin of safety?

Have there been fundamental changes in the assets I'm reallocating out of or into?

Is this based on data or narrative?

What could go wrong with this new allocation?

How would my portfolio perform in a market downturn with this new setup?

What’s the maximum drawdown risk I can tolerate from this reallocation?

What are the tax implications (capital gains, wash sales, etc.)?

Should I reallocate all at once or gradually (e.g., DCA, tranching)?

Would I make the same decision if I weren’t already holding the current assets? (Endowment effect check)

Have I documented the rationale and assumptions behind this reallocation?

What will make me reverse this decision, and when will I review it?

What does success look like for this reallocation in 3–6–12 months?

Thank you so much for reading! See you next week.