Issue #23: Top 5 Psychological Traps That Make You Lose Money

Impatience leads to costly investing mistakes. Discover the top 5 psychological biases that push investors to act impulsively.

Reading time: 4 minutes

Warren Buffett once said:

The stock market is a device for transferring money from the impatient to the patient.

Those who stay calm and committed for the long run often profit at the expense of short-sighted traders.

Many people enter the market hoping to “get rich quick,” but behavioral finance research shows that impatience and emotional reactions lead to mistakes that sabotage returns. Time and again, money tends to flow away from those chasing quick gains into the pockets of patient investors who stick to the plan.

The Value of Patience in Investing

Patience is a competitive advantage. Markets naturally fluctuate, sometimes wildly. Patient investors understand that enduring temporary dips is the price of admission for long-term growth.

However, impatient investors buy high and sell low as they react to each move of the market.

Below, I explore key psychological biases that drive such impatient behavior and how they negatively impact investment outcomes. Understanding these biases is the first step toward avoiding costly pitfalls.

Behavioral Biases Fueling Impatient Decisions

Loss Aversion

We feel the pain of losses much more strongly than the pleasure of gains. In fact, studies estimate that a loss psychologically hurts about twice as much as an equivalent-sized gain feels good. It can lead to fear-based, impatient decisions.

For example, you might panic-sell during a downturn to avoid further loss, locking in the loss rather than patiently waiting for a rebound.

Loss aversion also contributes to the disposition effect – the tendency to hold losing investments too long (hoping to break even) and sell winning investments too quickly (to “secure” the gain).

Such behavior will make you miss out on future gains from winners while clinging to losers that continue to erode your hard-earned wealth.

Hyperbolic Discounting (Present Bias)

We irrationally favor immediate rewards over larger rewards in the future. For instance, many people would prefer receiving $100 today over $200 one year from now, even though waiting would double their money.

Investors with this approach overlook how compounding builds wealth slowly over many years. Hyperbolic discounting thus leads to short-termism, a focus on now over later, which can severely limit your ultimate returns.

Overtrading and Impulsivity

Impatient investors often equate activity with progress. They constantly buy and sell in an attempt to “do something.” The urge comes from overconfidence in one’s ability to time the market or pick winners.

Well… if life would have been that easy…

A study of 66,000 brokerage accounts found that the most active traders earned an annual return of just 11.4%, while the overall market returned 17.9% in the same period.

In other words, frequent trading caused these investors to dramatically underperform the market. Their impatience to act racked up transaction costs and ill-timed trades that their profits.

Herd Mentality

It’s natural to feel safer in a crowd, which is why many investors follow the herd.

When markets rise, impatient investors rush to buy because "everyone else is buying."

When markets fall, they panic and sell alongside the crowd.

Herd mentality is rooted in two powerful fears: missing out and standing alone in a mistake.

Following the herd usually means buying at market peaks during the excitement and selling at lows amid the panic. History shows herd behavior repeatedly inflates bubbles and fuels crashes that lack fundamental justification.

During the dot-com bubble of the late 1990s, investors piled into tech stocks simply because others did, only to suffer heavy losses when the bubble inevitably burst. Chasing crowds results in impulsive investing, the opposite of the independent, patient approach needed for long-term success.

Short-Termism (Myopic Focus)

Impatience ultimately boils down to an excessive focus on short-term results. Short-termism causes investors to obsess over daily market noise or quarterly performance and lose sight of the big picture.

When you add loss aversion to the pot, normal market volatility becomes unendurable, which is a phenomenon researchers call myopic loss aversion, where investors who evaluate their portfolios too frequently become overly sensitive to short-term losses.

In practice, short-termism leads to knee-jerk decisions. You sell at the first sign of trouble or constantly and constantly switch investments looking for immediate wins.

One analysis found mutual fund investors gave up around 2% per year in returns by trying to time the market. That kind of performance gap is huge over an investing lifetime.

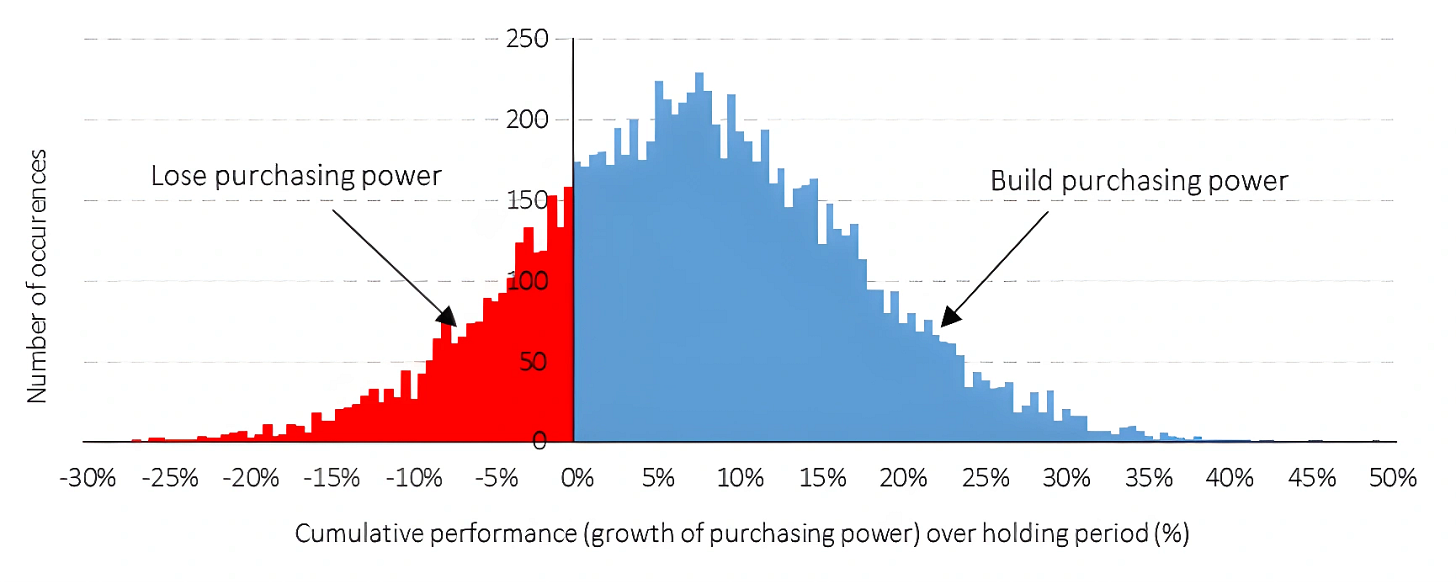

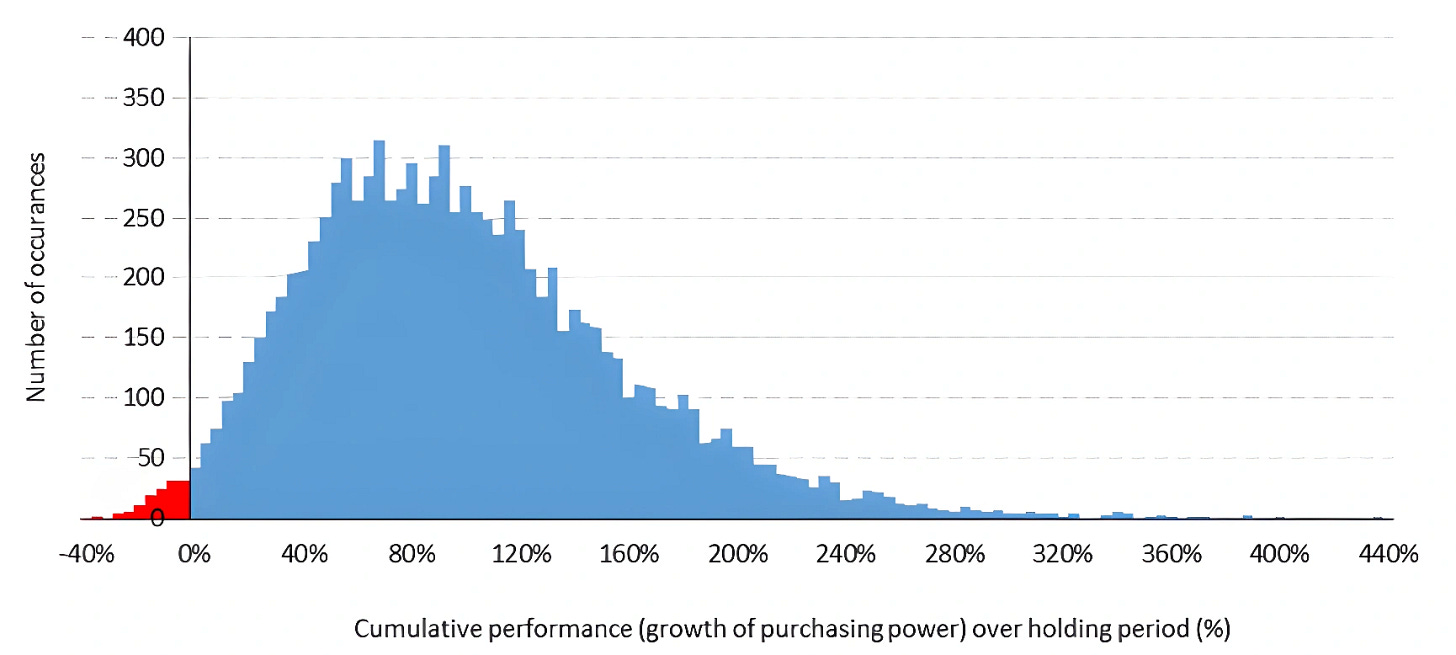

In any given year, a 60/40 stock-bond portfolio faces a significant chance of losing money. Roughly one-third of all one-year periods ended with a loss in purchasing power for investors holding such a portfolio.

Extend the horizon to 10 years, and the odds greatly improve. Most outcomes turn positive, clearly showing how patience rewards the long-term investor.

Thank you so much for reading!

Next Thursday, I’ll cover how to cultivate patience and avoid the traps that lead to impulsive investing. Stay tuned.